Monte carlo investment simulation

Monte Carlo simulations are a technique to simulate the uncertainties by building models with random samplings. While the Monte Carlo simulation does have numerous applications in a plethora of fields when it comes to personal finances this simulation is most used for portfolio.

Estimation Of Portfolio Sip Return Using Monte Carlo Python By Aadhunik Sharma Medium

A Monte Carlo simulation is a mathematical technique used to estimate possible outcomes of an uncertain event such as the movement of securities.

. Browse 42 LOS ANGELES CA MONTE CARLO SIMULATION job 33K-124K listings hiring now from companies with openings. A Monte Carlo simulation models the probability of different results in a way that cant simply be projected because of the intervening of random variables. Ad Backtesting Engine Made to Exactly Match Backtests in Your Trading Platform Test Faster.

The Monte Carlo simulation is a mathematical technique that predicts possible outcomes of an uncertain event. Monte Carlo Simulation is a statistical method applied in financial modeling where the probability of different outcomes in a problem cannot be. Ad Open a Brokerage Account to Gain Free Access to Courses on Stocks Bonds More.

Monte Carlo simulation is a statistical technique by which a quantity is calculated repeatedly using randomly selected what-if scenarios for each calculation. About Your Retirement. A Monte Carlo simulation shows a.

The uncertainties are modeled by probability distributions. Current Savings Annual Deposits Annual. Build Your Futures Trading Strategy Today at NinjaTrader Brokerage and Get Live Support.

Lets get started today. Try the simple retirement calculator. What is Monte Carlo Simulation.

This online Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival during retirement withdrawals ie. This Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival based on withdrawals eg testing whether the. Find your next job opportunity near you 1-Click Apply.

No Programming Ability Needed. Now lets define that. Our Monte Carlo retirement calculator runs 1000 scenarios where the rates of return for every investment changes in each year.

Fully Functional 14 Day Free Trial. Muthén Muthén 19982006. Ad Were all about helping you get more from your money.

Deep Discount Commissions Low Margins. Ad Keep Futures Trading Costs Low. Ad Keep Futures Trading Costs Low.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Within M plus the population and analysis models are easily specified and sum- mary in. Monte Carlo simulation is a mathematical technique for considering the effect of uncertainty on investing as well as many other activities.

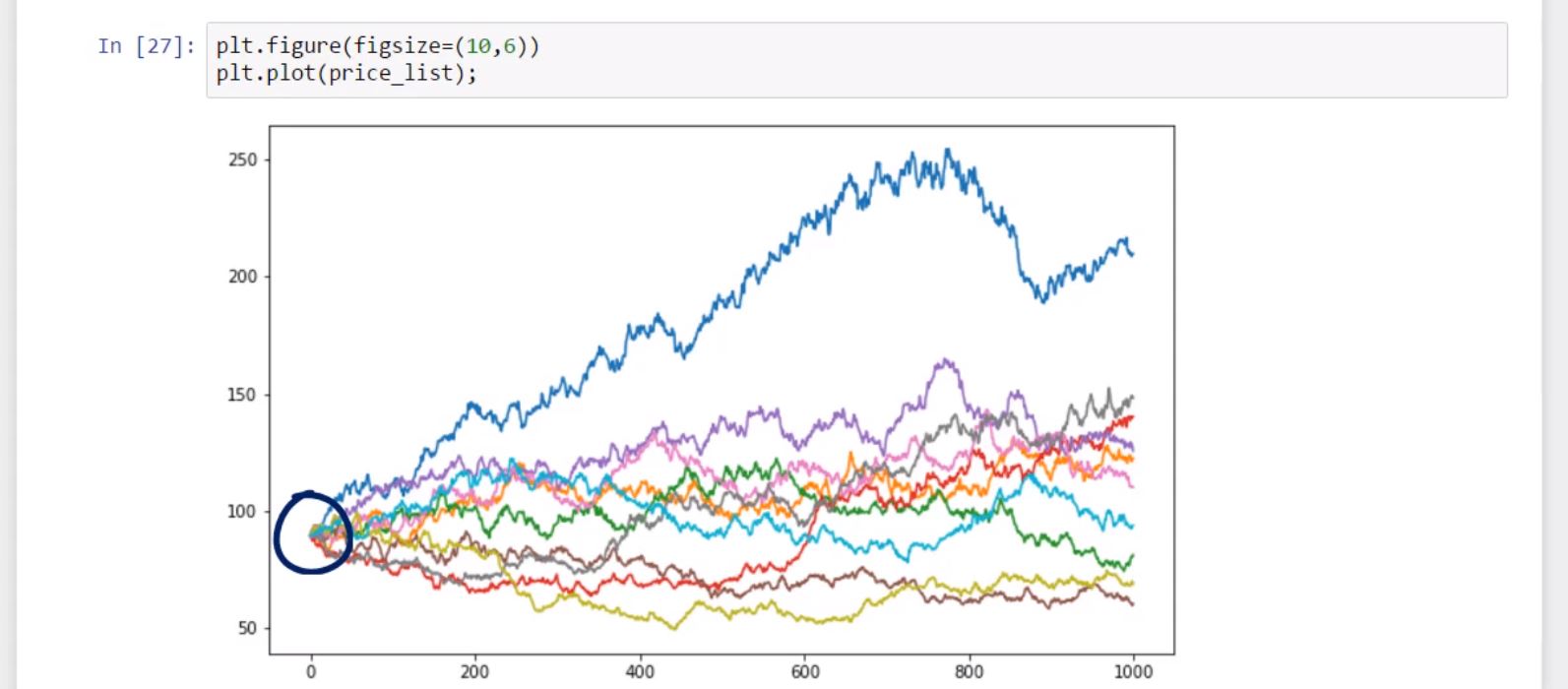

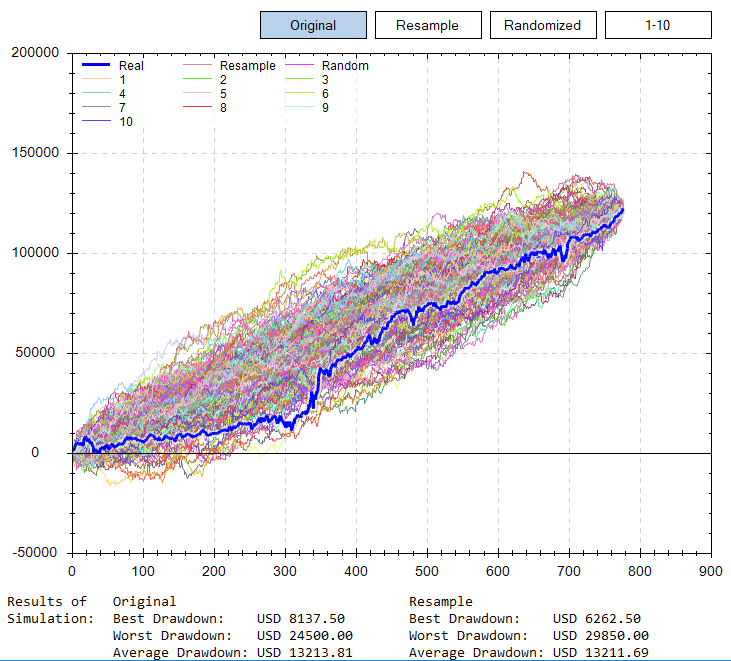

The basis of this analysis. Monte Carlo Retirement Calculator. In the previous article of this series we defined a Monte Carlo Simulation MCS as a sampling experiment whose aim is to estimate the distribution of a quantity of interest.

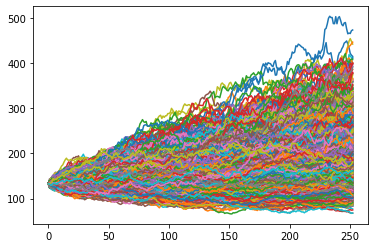

Monte Carlo Simulation is a mathematical method for calculating the odds of multiple possible outcomes occurring in an uncertain process through repeated random sampling. The Monte Carlo Simulation or Analysis Method named after the gambling casino in Monacothe epicenter of European gambling for nearly 175 years is a forecasting model that. Build Your Futures Trading Strategy Today at NinjaTrader Brokerage and Get Live Support.

Computer programs use this method to analyze past data and predict a range. Monte Carlo facili ties in M plus Version 41 L. We take the number of scenarios where money never runs.

We propose a novel simulation-based optimization framework for optimizing distribution inventory systems where each facility is operated with the r Q inventory policy. Deep Discount Commissions Low Margins.

Monte Carlo Simulation Advanced Investing Equities Lab

Monte Carlo Modeling In Personal Finance The Whoops Factor

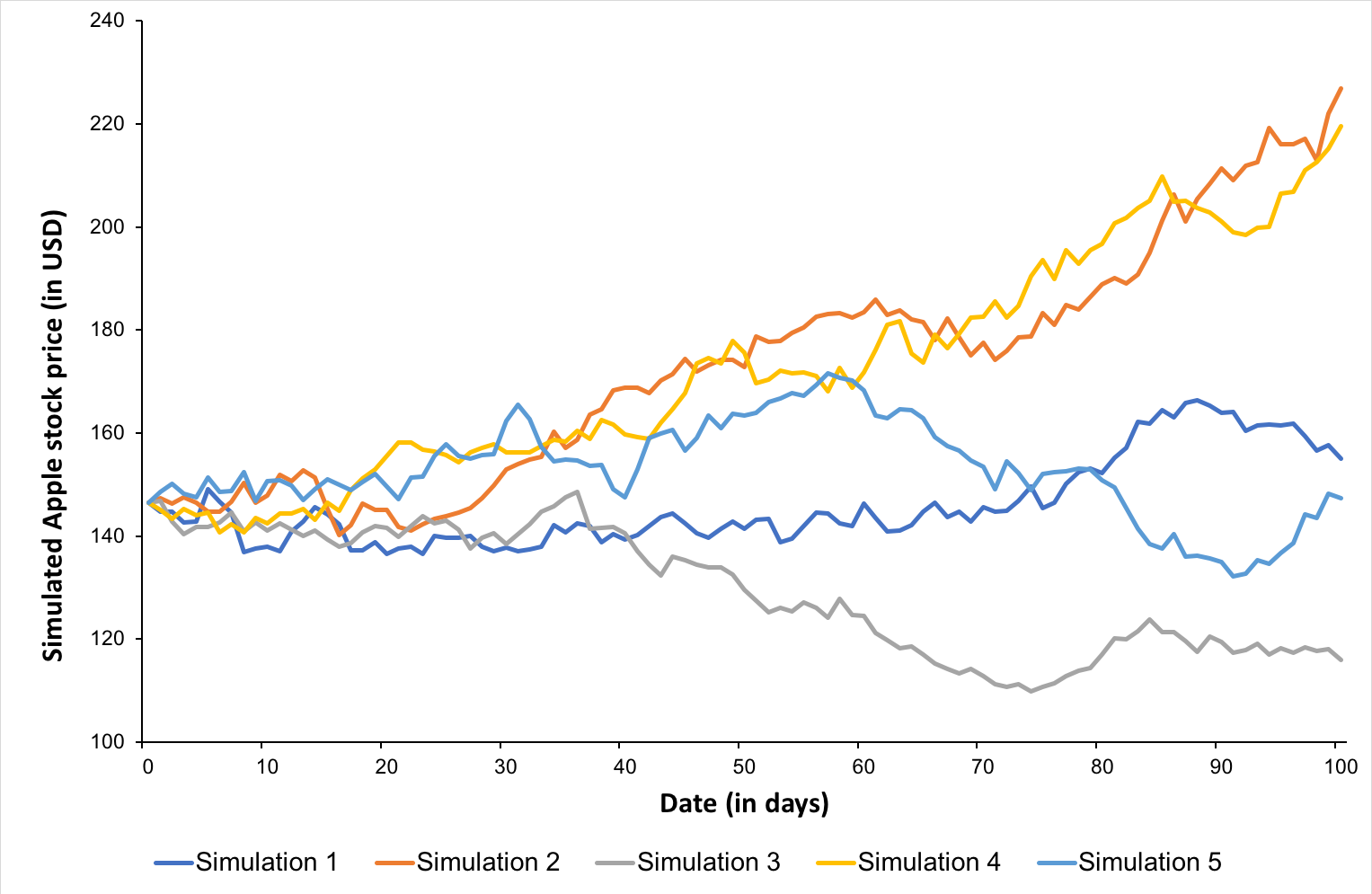

Monte Carlo Simulating Opus Banks Stock Price I 440 Analytics

A 20 Day Monte Carlo Simulation For Stock Price Prediction The Example Download Scientific Diagram

How To Apply Monte Carlo Simulation To Forecast Stock Prices Using Python Datascience

Simulating Future Stock Prices Using Monte Carlo Methods In Python Interviewqs

Monte Carlo Simulation Method Simtrade Blogsimtrade Blog

Stock Price Simulation Using Monte Carlo Methods Alteryx Community

Monte Carlo Simulation Excel

Using Monte Carlo Simulations To Settle Equitable Distribution Mycollaborativeteam Com

A 20 Day Monte Carlo Simulation For Stock Price Prediction The Example Download Scientific Diagram

Simple Monte Carlo Simulation Of Stock Prices With Python Youtube

Monte Carlo Simulation Of Stock Price Movement Youtube

Monte Carlo Modeling In Personal Finance The Whoops Factor

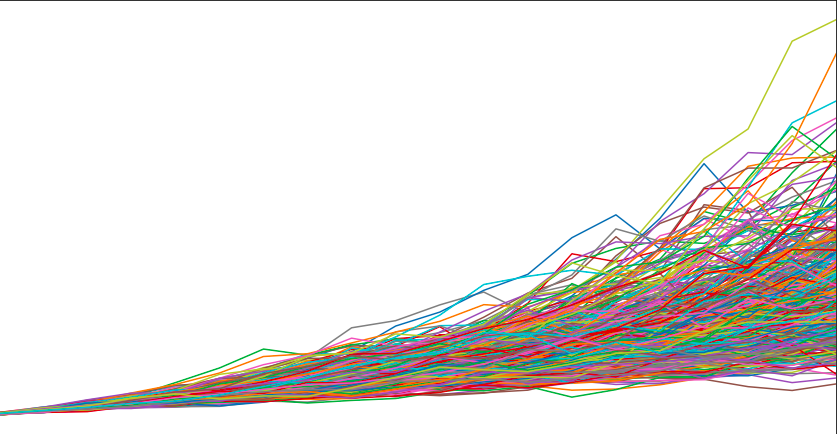

Matlab Tutorial Monte Carlo Asset Paths

Monte Carlo Simulation In R With Focus On Option Pricing By Ojasvin Sood Towards Data Science

3 Of Many Uses For Monte Carlo Simulations In Trading See It Market